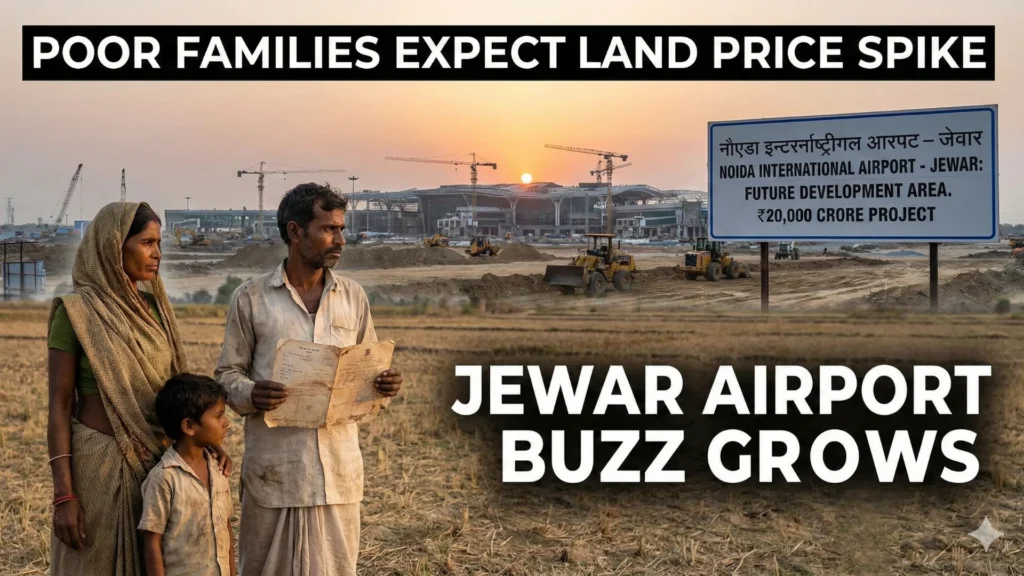

Poor families living near Noida International Airport (Jewar) are expecting a land-price spike because “airport + new connectivity” almost always turns nearby villages into a hot investment belt. The ₹20,000 crore buzz is growing mainly because multiple big-ticket projects are stacking in the same zone—airport development plus new transit connectivity plans—so people assume demand will jump for plots, rentals, shops, and warehousing. The reality is: prices don’t rise evenly everywhere, but the moment interchange roads, metro/RRTS links, and logistics movement become clear, land quoting usually starts moving faster than locals can predict.

Design and Build Quality

Jewar airport is being built as a major greenfield hub with long-term phased expansion, and the scale itself changes the whole region’s development mood. Official planning documents show phased passenger capacity build-out and big capex figures, which is why locals treat it as a multi-decade growth engine rather than a one-time construction site. When an airport is planned in phases and supported with strong approach corridors, the surrounding belt tends to shift from “pure farming” to “mixed economy” over time.

Connectivity and Daily-Life Impact

A major reason for the current noise is that new regional transit connectivity is also being discussed for airport access. For example, the Ghaziabad–Jewar RRTS corridor has been defended as a key connector, and the project cost being reported is ₹20,360 crore, which matches the kind of “₹20,000 crore buzz” people repeat in local talk. Better connectivity usually means more movement of workers, services, and businesses—exactly the triggers that can lift demand for rentals and small commercial plots near access points.

How Land Prices Typically Rise Around Airports

Land price “spikes” usually happen in stages, not overnight. First comes the rumor-and-headline jump. Second comes the survey/notification jump when people see markings and paperwork movement. Third comes the operational jump when traffic patterns become real and businesses start committing money. The fastest appreciation is typically seen near approach roads, interchange zones, and areas with clean access to expressways or planned transit nodes—while interior villages can rise slower unless they get direct connectivity links.

Rehabilitation, Compensation and Ground Reality

The ground reality near Jewar also includes land acquisition and rehabilitation planning, which affects poor families differently than investors. Recent reporting mentions expansion phases that could impact thousands of families and outlines compensation and rehabilitation provisions, including land compensation figures and allowances in draft plans. For many households, the “land boom” story is mixed with anxiety about acquisition terms, relocation, and whether new development actually improves income stability. This is why the same airport that excites investors can feel stressful for families living right inside the acquisition belt.

Price Buzz and Smart Strategy for Poor Families

If you’re close to Jewar, the smartest move is usually calm planning: keep land papers clean, avoid rushed cash deals, and track which areas actually have official access-road certainty. Land near future junctions can sometimes generate better long-term value through leasing (shops, small rentals, storage) than a quick sale at the first spike. And one important point—“₹20,000 crore” gets used loosely in local talk; some of that number is being tied to major connectivity projects as well, not just one single airport bill. Knowing what exactly is being funded helps families separate real opportunity from pure hype.